Report: Federal Government Cuts Will Shrink Illinois Economy by $10 Billion Annually And Cost 86,000 Jobs

Analysis Explores Impact of Cuts, Project Cancellations, Funding Recissions, and Mass Federal Firings on Illinois

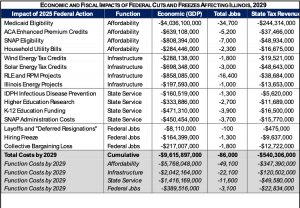

LA GRANGE, IL, UNITED STATES, December 1, 2025 /EINPresswire.com/ -- By the end of President Trump’s term, the wave of project cancellations, funding recissions, mass federal firings, and cuts to public health, nutrition, infrastructure, education, and other programs enacted by the administration in 2025 will amount to nearly $8 billion annually in lost revenue and increased out-of-pocket expenses, shrink the economy by $10 billion per year, and cost the state 86,000 jobs—according to a new analysis by the nonpartisan Illinois Economic Policy Institute (ILEPI) and the Project for Middle Class Renewal (PMCR) at the University of Illinois at Urbana-Champaign. The report also finds that these actions will cause hundreds of thousands of Illinois residents to lose access to health insurance coverage and food assistance, while shrinking state tax collections by more than $1 billion per year.Read the report, “Federal Funding Cuts and Freezes: Consequences for Illinois.”

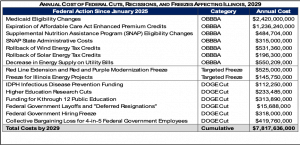

For the analysis, researchers examined the impact of cuts across three broad categories: the budget reconciliation law passed by party-line vote in Congress in July 2025 (known as the “One Big Beautiful Bill Act”), recissions and administrative cuts announced as part of the administration’s “government efficiency” efforts, and targeted funding freezes aimed at states with Democratic Governors during the federal government shutdown that began in October of 2025. Researchers utilized industry-standard IMPLAN analysis to identify broader economic and fiscal impacts.

“The data shows that in just nine months, federal funding cuts and freezes have created headwinds that will weigh down our economy and add new fiscal burdens for state and local governments for years to come,” said ILEPI Economist and study coauthor Frank Manzo IV. “This is especially alarming because Illinois is already a ‘donor state’ that contributes billions of dollars more every year in federal taxes than it receives in federal spending and investments.”

In addition to the economic and fiscal impacts of Trump administration cuts, the report also projects the human toll that changes to Medicaid, food stamps, the Affordable Care Act (ACA), and energy production programs could mean for Illinois residents. It finds these cuts will cause at least 270,000 state residents to lose Medicaid coverage, another 216,000 to lose access to food stamps, and at least 100,000 to lose their health insurance under the ACA, while increasing the average family’s energy bills by up to $186 per year in the next five years.

“This is happening at a time when the cost-of-living and energy demand are both skyrocketing, and will hit the state’s most economically vulnerable families the hardest—including those with children and people with disabilities,” Manzo added.

Many of the Trump administration’s policy changes will either shift program funding burdens to states or result in dramatically lower revenue streams for state governments. This includes $315 million in new state costs to administer Supplemental Nutrition Assistance Program (food stamp) benefits, $550 million in cuts to K-12 public schools and higher education, $110 million in recissions for infectious disease control and prevention, the suspension of more than $600 million in federal transit and energy project funding during the recent government shutdown, and more than a billion dollars in lost state income and corporate tax collections due to tax law changes in favor of large businesses and downsizing the federal workforce.

In an attempt to address negative impacts of these federal cuts and freezes, Governor Pritzker issued an Executive Order in September calling for agencies to identify cost efficiencies and reserve 4% of General Fund appropriations. Researchers cautioned, however, that these actions may only offset a fraction of the impacts of the Trump cuts and that additional revenue sources may be needed.

“It’s important to remember that federal investments translate not just to benefits, but to business income, worker paychecks, tax collections, and spending across all sectors of the economy,” added PMCR Director, University of Illinois at Urbana-Champaign Professor, and study coauthor Dr. Robert Bruno. “These unwarranted and thoughtless cuts were a self-inflicted wound, and their impacts will be far-reaching, damaging, and lasting across all parts of our economy.”

The Illinois Economic Policy Institute (ILEPI). is a nonprofit, nonpartisan research organization founded in 2013 to deliver actionable research and expert analysis on public policy issues impacting businesses, working families, and taxpayers.

The Project for Middle Class Renewal (PMCR). at the University of Illinois at Urbana-Champaign investigates working conditions in today's economy to elevate public discourse aimed at reducing poverty, create more stable forms of employment, and promoting middle-class jobs.

Todd Stenhouse

Illinois Economic Policy Institute

toddstenhouse@gmail.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.