Canned Pet Food – Top Global Industry Trends in 2026

Rapid premiumization, science-backed nutrition, and sustainability commitments are transforming the global canned pet food landscape.

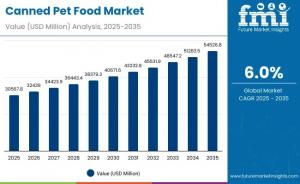

NEWARK, DE, UNITED STATES, November 21, 2025 /EINPresswire.com/ -- The global Canned Pet Food Market is poised for strong growth, projected to rise from USD 30,567.8 million in 2025 to USD 54,526.8 million by 2035, driven by premium wet diets, veterinary-grade formulations, and evolving consumer preferences for clean-label and human-grade pet nutrition.

This growth marks a 6.0% CAGR over the decade, nearly 1.8X expansion in market size, with demand accelerating significantly after 2030 as sustainability and digital commerce reshape competitive strategies.

Explore trends before investing – request a sample report today! https://www.futuremarketinsights.com/reports/sample/rep-gb-26666

Premiumization Drives the First Growth Wave (2025–2030)

Between 2025 and 2030, the market expands from USD 30,567.8 million to USD 40,671.6 million, contributing 42% of decade growth. Premium canned diets, grain-free labels, and functional nutrition formats dominate, backed by strong veterinary endorsements. Dog food remains the leading segment, accounting for over half of total demand, with meat-based recipes, especially chicken and beef, continuing to command category leadership.

Clean-Label & Human-Grade Diets Power the Second Wave (2030–2035)

From 2030 to 2035, the market adds USD 13,855.2 million (58% of total growth), fueled by organic, human-grade, and insect-protein wet foods. Cat food emerges as the fastest-growing category, especially in urban centers across Europe and East Asia, where smaller living spaces make cats the preferred household pet.

Key Data Highlights at a Glance

Quick Stats (2035 Forecast):

• Market Size: USD 54,526.8 million

• CAGR (2025–2035): 6.0%

• Top Regions: North America, Europe, South Asia & Pacific

• Leading Segment (2025): Dog Food

• Top Companies: Nestlé Purina PetCare, Mars Petcare, Colgate-Palmolive, General Mills, Simmons Pet Food

Why Consumers are Switching to Canned Pet Food

Growing pet humanization is making pet diets resemble human nutrition. Advances in food science now support:

• Enhanced digestibility & palatability

• Functional benefits like immune, digestive, and renal health

• High-quality protein sources and organic positioning

Sustainability is emerging as a key motivator, which is boosting plant- and insect-based wet diets among environmentally conscious buyers.

Segment Insights: Dogs Lead, Cats Rise

Canned Pet Food by Pet Type (2025):

• Dog – 55.1%

• Cat – 40.2%

• Others – 4.7%

Dog food maintains dominance due to higher intake volumes and growth in functional wet diets. Cats are projected to expand faster, driven by urban ownership trends.

Canned Pet Food by Ingredient (2025):

• Meat-based – 68.4%

• Other proteins & alternatives – 31.6%

Chicken and beef remain staples, while exotic and sustainable proteins such as venison, duck, and insects capture premium growth.

Market Drivers, Restraints & Emerging Trends

Key Drivers

• Surge in protein-rich and functional wet diets

• Rapid adoption of canned cat food in urban markets

Restraints

• High price gap vs. dry food

• Packaging and recycling challenges

Trending Shifts

• Rise of insect and exotic protein canned formulations

• Subscription-driven D2C platforms boosting premium food penetration

Regional Growth Outlook

Asia-Pacific is one of the fastest-growing markets, led by China and India (each 5.2% CAGR). Premium cat food adoption, expanding middle-class income, and online sales are driving demand.

Europe remains innovation-centric, with Germany (6.8% CAGR) leading clean-label and sustainability trends.

North America, led by the USA (6.1% CAGR), is witnessing robust growth in veterinary-recommended and human-grade wet diets.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates. https://www.futuremarketinsights.com/reports/brochure/rep-gb-26666

Competitive Landscape

The market remains moderately consolidated, with Nestlé Purina PetCare, Mars Petcare, and Colgate-Palmolive dominating premium and veterinary wet diets. General Mills (Blue Buffalo) leads in natural and grain-free products, while Simmons Pet Food strengthens private-label growth. Competitive differentiation is transitioning toward:

• Sustainability-focused packaging

• Human-grade and transparency-driven diets

• Omnichannel distribution & direct-to-consumer subscriptions

Recent Industry Developments

• Feb 11, 2025 – Nestlé Purina added a transparent jelly wet cat food variant to its Gourmet Revelations line in 15 European markets.

• Jun 3, 2025 – Mars Petcare and partners launched a Global Pet Food Innovation Program to accelerate sustainable protein technology for wet and canned diets.

Browse Related Insights

Canned Tuna Market: https://www.futuremarketinsights.com/reports/canned-tuna-market

Canned Soup Market: https://www.futuremarketinsights.com/reports/canned-soup-market

Canned Meat Market: https://www.futuremarketinsights.com/reports/canned-meat-market

Why FMI: https://www.futuremarketinsights.com/why-fmi

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.